By: Bobby McFadden, kWh Analytics; Chris Bartle, Ciel & Terre; James Markos, Willis Towers Watson

Originally published by PV Tech Power

Solar power is expanding rapidly, accelerated by incentives like the U.S. Inflation Reduction Act. With land constraints near populated areas, clean energy growth is occurring in floating photovoltaics on bodies of water, also called FPV or floatovoltaics. This novel technology functions much the same way as traditional solar, but instead of installing racking in or on the ground, panels are set atop floating platforms, with tethers from the platform to the bottom and/or shoreline of lakes, reservoirs, or quarries.

Though, FPV today only make up around 2% of new global solar installations, the fleet is growing with projects coming online rapidly. While this emerging technology presents exciting opportunities, it also brings new, previously unconsidered risks that insurers need to understand.

Floatovoltaics could be an ingenious way to generate necessary clean energy while saving precious land space. Some advantages of FPV include:

Makes Use of Unused Space: These projects are installed on non-recreational reservoirs, quarries, and ponds, utilizing areas that would otherwise be unused.

Increased Solar Panel Efficiency: Positioning panels on water enables natural cooling that increases efficiency and output, especially during summer peak demand.

Grid Connection Benefits: Co-locating projects with hydroelectric dams simplifies grid connections to export the solar power generated.

Repurposing Contaminated Waters: Contaminated quarries and mining ponds can be repurposed for clean energy production.

Water Conservation: Covering water surfaces with floatovoltaics reduces algae growth and evaporative water losses.

Image courtesy of Ciel & Terre International

However, floating solar has its challenges. The remote positioning of floating solar arrays in the middle of a water body can impact how a battery energy storage system might be utilized for additional revenue, depending on whether a DC or AC connection from the FPV is chosen. Current systems also do not employ trackers, whereby panels are tilted to the optimal production angle throughout the day. The nature of these systems requires specialty handling, equipment, and maintenance, which can be time-consuming and costly.

Floatovoltaics, as an emerging technology, presents unique risks and opportunities that insurers, asset owners, and their brokers should fully comprehend. The unique benefits of repurposing non-recreational bodies of water also provide motivation. Beyond land constraints driving adoption, floating solar maximizes usage of available surface area to expand renewable energy generation potential compared to acreage-limited ground-mount developments. As further innovation addresses initial challenges, insurers can expect floatovoltaics' share of new solar installations to grow.

Technology Overview & Project Development Considerations

Fundamentally, floatovoltaics utilize similar photovoltaic panels, inverters, and other components as conventional ground or roof-mount solar installations. The differentiation arises in supporting these electrical assets over bodies of water instead of terrestrial real estate. This approach enables harnessing more surface area for solar resources without land constraints or clearing habitats. However, effectively designing equipment and infrastructure to withstand an aqueous environment also introduces unique engineering challenges.

Floatovoltaic systems comprise three primary elements - the floating platform, the electrical system, and anchoring/moorings. A common floating structure typically uses modular HDPE or composite plastic floats connected via polypropylene pins to assemble into a unified array. Strings of PV panels along with wiring, converters, and combiner boxes mount atop this buoyant platform, elevated safely above water. Underwater or floating Direct Current (DC) cables then transmit generated electricity to shoreside inverters and switchgear equipment, typically located near existing transmission infrastructure, or can be fastened to a floating equipment barge. If inverters are on floats near the arrays, an AC cable would then connect to the shore tie. The extensive anchoring and moorings keep this floating island securely fastened through waves, winds, and water level fluctuations. The system utilizes spreader bars (where the mooring line assemblies attach to the floating asset site, or ‘island’) adjustable chains, galvanized steel cabling, and elastic rope shock absorbers all corrosive-resistant and expertly tensioned. Site selection and system design confront additional considerations compared to traditional solar developments. Typically, water bodies are chosen based on technical limitations and functionality. Sites with limited recreational use, such as hydro dams, quarries, and reservoirs, make ideal placements for FPV. The water body itself must meet the following technical limits:

1. Max wave height: 1 meter

2. Max surface flow rate: 1 m/s

3. Lowest temperature: -40 F/C

4. Max ground snow load: 60 psf

5. Max water level variation achieved to date: 100 ft

Choice waterbodies limit sediment accumulation and depth changes while avoiding valuable recreational or commercial navigation routes. The bottom of the waterbody must be reachable in case maintenance activities or cleaning is required. The choice of site is extremely important: islands can be moved around on the water surface but are not intended to be removed or disassembled until decommissioning. If moving them, there needs to be secondary sets of anchors installed so the island(s) are always anchored.

The project development process for floating solar is the same as it would be for ground mount or rooftop with the following differences:

Bathymetric surveys are utilized to map underwater bottom terrain to inform array placements and necessary cable slack.

Decisions occur on walkway access versus service boats for ongoing operations and maintenance needs.

Key design factors revolve around water conditions and weather resilience in the chosen location, and anchoring and float spacing adjustments are made accordingly with allowable wave heights and surface currents.

Floatovoltaics are not immune to the effects of weather and natural catastrophes. As water levels periodically drop or seasonal ice thaws, low-sitting floating platforms that are properly moored can come to rest securely on exposed lakebed, as long as the tilt angle between floats does not exceed 15 degrees. These assets are not installed with trackers and do not typically have hail stow capability. To better protect from hail, enhanced tempered and thick glass is utilized. Integrated lightning rods and fire suppression equipment provide further safeguards.

Recent major global projects include the 8.9MW Canoe Brook installation in New Jersey. Meanwhile, Dezhou, China now hosts the world’s largest operational floatovoltaic site at over 320MW, exemplifying rapid adoption across Asia as the industry matures.

Risk Management & Loss Control

For covering unfamiliar technologies like floatovoltaics, clearly explaining the engineering basis and focusing on embedded risk mitigation strategies is key for securing insurer participation across critical property, equipment breakdown, and other coverage lines. Once a project receives the go-ahead, collaboration with clients is to outline potential equipment breakdown (PEB) risks is an important step to address how project risks were addressed from the design phase through the operational life of the asset. This collaborative communication ensures all stakeholders understand preventative preparations enabling performance.

Since there is no generally accepted engineering standards or guidelines specifically for designing FPV, one should look at what current standards are utilized by the supplier, how they were applied specifically considering site requirements, followed by a review of how third-party certifications confirming the system will perform and survive for the expected life of the project. Examples of some standards references or guidelines that might be useful to review when pursuing a floating solar project includes:

Bureau Veritas’ NI 605 DT R00, which was developed for use with foundations and anchoring of offshore structures.

DNV-GL has developed a Recommended Practice, DNVGL-RP-0584, for the design, development and operation of floating photovoltaic systems

World Bank’s Where Sun Meets Water, Floating Solar Handbook for Practitioners

American Society of Civil Engineers (ASCE) design codes, while not pertaining to floating solar do provide guidance for structures to withstand wind, snow load, and similar conditions.

In preparing for a recent client’s initial floatovoltaic project, Willis Towers Watson’s renewable energy team held discussions with various insurers’ underwriters and risk engineers regarding their perspectives on this asset type. It became evident that floating PV was considered a new and unfamiliar solar application for most domestic insurance companies, especially at the utility-scales seen globally. Most US projects are below 10 MW, with some less than 1 MW, while Asia has commissioned over 300 MW in floating solar capacity.

Concurrent with the insurer dialogues, conversations also occurred with several floating solar system providers to understand their engineering, testing, and installation approaches. Perspectives were shared around the important role brokers and insurers play in supporting project developers to obtain appropriate insurance coverage and how system vendors can facilitate that process.

To further the understanding of floatovoltaic system risks, below is a review potential equipment breakdown exposures floating solar presents.

The mooring or anchoring system is the primary risk differentiator compared to conventional solar installations. The design and component materials must be tailored to characteristics unique to the site, including modeling conservative wind, wave, and flood assumptions when engineering mooring and anchor durability specifications. In-depth geotechnical studies help determine the optimal anchoring approach, whether submerged moorings, shoreline attachments, or a combination. Numerous techniques exist - such as deadweight anchors, driven screw piles, anchored perimeter pillars - each with merits and downsides. The flexible lines linking to these anchor points face exposures too, with options like steel wire cable, chains, and high-performance ropes to select appropriately. The modular floatation system warrants similar context-specific planning, with materials ranging from high density polyethylene to composites forming the bases that ultimately underpin the solar arrays. Hardware and connections must prove corrosion resistant while supporting loads. Even access walkways and equipment transport barges require deliberation to enable ongoing operations and maintenance. By tailoring these foundations to the conditions at hand, the resultant reliability fundamentally impacts overall system viability.

Image courtesy of Ciel & Terre International

The photovoltaic panels themselves resemble models utilized for ground-mounted installations, although tailored racking, mounting, and support hardware attaches instead to the floating platforms. Those component materials must withstand corrosion from the surrounding environment, with options including marine-grade aluminum, stainless steel, coated carbon steel, fiberglass reinforced plastics, polypropylene, and HDPE. Trackers and hail stow capability are generally not an option with this system type, which introduces some increased weather vulnerability. However, FPV is generally constructed in areas with low hail risk.

The electronic components resemble standard ground-mount solar but warrant customizations for aquatic conditions. Inverters, transformers, junction boxes, combiners, monitoring systems, and most wiring use comparable components, albeit with specialized enclosures and connectors. Central inverter stations and transformers can float on equipment barges, and string inverters can be placed on the array. Particular considerations apply for routing cables - options include cable trays suspended above water or underwater marine-grade cables. While the layout mimics land-based equipment, the nuances of transmitting electricity from floating generation assets to distant interconnections require thoughtful adaptations without compromising safety or production.

Risk Considerations

Natural catastrophes pose immense threats to floatovoltaics that proper siting and engineering design strives to withstand. Detailed hazard models determine expected peak wind, precipitation, seismic activity, and flood levels that establish structural specifications. Still, failures leading to detached arrays or connecting cable breaks trigger revenue and equipment loss potentials. Innovation continues to protect this asset class: anchoring improvements continue to better adapt to rising waters, while ongoing surge suppression advances seek to limit lightning-sparked fire risks. Working with insurers as the technology continues to evolve will help create customized terms for this asset class.

Ongoing operations and maintenance proves equally vital for preserving floatovoltaic functionality, albeit aquatic conditions introduce complications. Technician access usually necessitates boats or floating bridges, adding costs and weather-dependent delays. The lack of trackers avoids some moving part repairs but static positioning increases weather exposure. Reliable performance necessitates remote monitoring enables rapid diagnostics and response coordination for identified faults. Insurers can further aid resilience by requiring ample replacement component stocks and technician training programs.

General corrosion and erosion risks also multiply with FPV, necessitating durable materials selections and coatings. Pre-deployment water analysis determines precise chemical properties to model deterioration rates over decades and specify appropriate panel compounds and protective sealants. Ultraviolet radiation steadily degrades plastics, cabling jackets, and rubber without proper additive shields. Regular cleaning and scheduled underwater surveys can help confirm minimal accretion or insulation damage. Insurers complement via policy terms stipulating these inspection, testing, and replacement frequencies contractually.

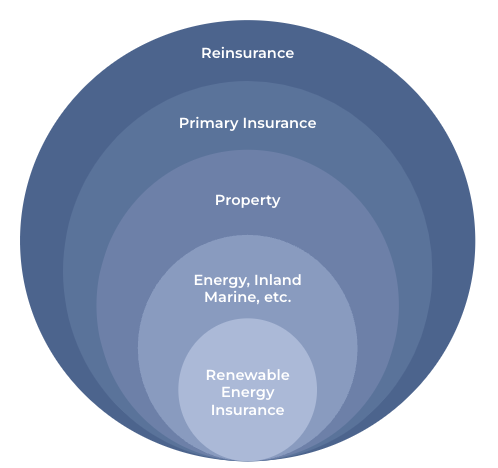

Insuring Floatovoltaics

New and rapidly evolving technologies are still niche in the PV industry, and dealing with the associated emerging risks has become an accepted cost of progress. This has proven to be quite challenging for the insurance industry, however, especially in predicting the loss profiles of new technology which has not had substantial time in the field. With any asset, the carrier’s mandate is to understand the losses that should be expected in a given year, and what losses are in extreme events, such as 1 in 500-year flood or fire events. This presents challenges, especially in the use of natural catastrophe, or ‘nat cat’ modeling software, which only support modeling of certain types of constructions, and are slow to incorporate new technologies. Without historical loss data and predictions from modeling, insurers have to get creative in the way they think about these emerging risks. The brightest and forward-thinking insurers turn to existing research, and sometimesconduct their own.

Battery Energy Storage Systems, or BESS, serve as a great example of how carriers get their arms around cutting-edge continuously evolving technology. Diligent underwriters have worked with the industry and modeled data to understand what factors lead to thermal runaway events and how certain chemistries are more prone to thermal events than others. As another example, hail stow trackers were introduced to the industry as a hail risk mitigator. Considering this resilience effort in underwriting included calculating the kinetic energy reduction due to the tilt angle of the panel when hail strikes, taking this into account along with lab testing results on different modules’ glass thicknesses. Each new type of technology requires new methods to evaluate the risk, which can be used in conjunction with any loss data available.

kWh Analytics employs data scientists, some with engineering and physical science backgrounds, to work with underwriters to consider all the data and evidence as a whole when writing these risks. This method is applied to floatovoltaics as well, in understanding the effects of natural catastrophes on these systems, extrapolating loss data from other parts of the world to apply to US assets, and determining maintenance, replacement, and business interruption costs.

Insurance policies for floatovoltaics projects diverge in critical ways from standard solar development coverage given the distinctive nature of these water surface based systems. As an emerging technology, inadequate historical data on damage frequency and claims experience further complicates reliable risk assessment. Insurers must collaborate closely with developers and equipment manufacturers to institute loss control stipulations and craft policy terms that balance premiums with adequate protections.

The effect of major natural catastrophes on these systems is an important consideration in underwriting floatovoltaics. From the anchoring and moorings securing arrays on the water surface to the transmission cables underneath, insurers must evaluate a range of site-specific perils.

Flood: The anchoring and mooring systems are designed to adjust to varying water levels, providing resiliency against flood damage. This enables more favorable flood coverage compared to ground-mount solar sites. The anchorings also account for lateral wind and water flow forces.

Earthquake: The anchoring system's capacity to handle changes in water levels also provides secondary protection against lateral seismic activity and horizontal loads. This resiliency can allow for enhanced earthquake policy terms.

Hail: Most floatovoltaic installations utilize fixed-tilt racking, which leaves arrays more exposed to hail strikes since stow capabilities are not available. Hail coverage may need to account for this increased vulnerability.

Fire: Accessing floating arrays far from shore poses challenges for fire response, containing outbreaks, and controlling spread across water. Some sites employ a bridge to the island, allowing for easier access. Insurers may limit fire coverage or impose specific loss control measures to mitigate this risk.

Insurers can also reference other marine projects when evaluating floatovoltaics since certain characteristics overlap. This includes assessing resilience measures for floating platforms and docks, elevation tolerances for electrical components, and specialized considerations for fire protection and O&M services. As the floatovoltaics insurance market matures in step with broader industry growth, compiling data around actual losses will clarify how these assets perform through extreme weather and lifecycles. This will enable fine-tuning underwriting guidelines as challenges are conquered but new vulnerabilities also inevitably emerge with any pioneering technology.

As an emerging technology, education around the intricacies of floatovoltaics is imperative for insurance brokers and underwriters new to this sector. With rapid global growth projected in floating solar installations, gaining understanding now prepares stakeholders for the wave of new projects seeking insurance policies customized to their distinctive needs.

Proactively engaging with asset owners and manufacturers allows brokers and carriers to best advise clients on properly structuring risk management programs. For carriers, understanding the nuances enables appropriate policy terms, conditions, and pricing that matches the risk profile. While risk mitigation measures around priority perils continue maturing, the diligence today will allow insurers to incorporate best practices.

CASE STUDY: CLAIMS SCENARIO

While advances continue improving durability against damage, floatovoltaics still present unique claims scenarios. Defective anchoring systems make arrays susceptible to panel detachments from high winds or large waves. Usually occurring during storms, they can also fail gradually over time from undiagnosed flaws and unnoticed corrosion. kWh Analytics currently insures a floating solar project utilizing high-quality equipment from industry leader Ciel & Terre. The anchoring system specs were reviewed to gain comfort over the system’s resilience to wind load and changes in water level. Site-specific considerations were also made for the anchoring and mooring system implementation. The anchoring utilizes galvanized steel shackles, cables, chains and stabilizers to prevent corrosion and account for water level changes.

Another vulnerable period is maintenance activities when accessing equipment on the water, which exposes technicians and parts to greater environmental hazards. Even theft, vandalism, or negligence, also known as attritional risks, increases during construction before safeguards are fully implemented. Other scenarios like snow load accumulations stressing structural integrity or cabling destruction from extended UV radiation exposure underscore the importance of insurance protection. The kWh insured site includes a floating bridge for routine maintenance access to the floating-ballasted array and supported PV equipment.

Overall, the insured’s robust design and installation, coupled with the manufacturer's expertise, provided strong resiliency measures that enable comprehensive underwriting analysis. Insuring this risk is an opportunity to cover best-in-class emerging technology and support the future growth of floatovoltaics.

Floatovoltaics represent an exceptionally promising market expansion opportunity for solar energy. By siting photovoltaic systems on non-usable bodies of water rather than premium real estate, this technology can unlock additional renewable generation capacity critically needed for sustainability targets, often close to where the electrical demand is needed. Though floatovoltaics only make up a small portion of today’s renewable energy fleet, rapid cost improvements coupled with supportive government incentives position this sector for immense growth in suitable regions worldwide.

Yet as an emerging field still maturing, risks remain that may deter uptake if not adequately addressed. Insurers play a vital role not just in comprehensively evaluating floatovoltaic vulnerabilities, but also collaborating closely with developers to promote safety and resilience through loss control stipulations. Leveraging data science, engineering expertise, and lessons from analogous assets enables shaping prudent underwriting guidance during this formative market phase. Adoption of best practices will allow progressive improvement of insurance terms as statistical credibility accumulates over time.

The long-term outlook remains bright for floatovoltaics contributing materially to de-carbonization. However, maintaining sustainable expansion requires asset owners, brokers, and carriers to collaborate on the growth of this technology frontier. The efforts undertaken today to understand the intricacies of floatovoltaics will establish foundations for successfully scaling this innovative solar domain, unlocking its immense potential to combat climate change.